I want to buy a house. Where do I start?

Buying a home is likely the most expensive transaction you will make in your lifetime. It can be a bit overwhelming. At times, it can even feel impossible. How do you prepare to buy a home? How do first-time homebuyers find the cash for a down payment and closing costs? How much does it all cost? Rest assured, these are all questions we hear and answer every day. Let’s start with two main aspects

Identify how much you can afford.

Before taking a deep dive into online listings or touring homes, you should identify what monthly payment you can comfortably afford. How much are you currently paying for rent? That should be a good starting point. Once you identify what is a reasonable expense, break that into sections. In addition to the principal and interest on your home loan, you should factor in homeowner’s insurance, property taxes, potential HOA fees, and any private mortgage insurance. If you aren’t currently paying for utilities (water, gas, electric, etc) be sure to add in some estimated amounts for those as well. Once you have that total number, it is a good rule of thumb to add in a monthly contribution to a rainy day fund for any unanticipated repairs and maintenance. Homes require upkeep and setting aside money each month in anticipation of this will be a major lifeline when needs arise. Now that you know how much you are able to comfortably pay each month, it is time to nail down how much money you will need up front: down payment and closing costs. Working with an experienced mortgage broker can be help you nail down these anticipated costs and identify a reasonable budget.

How much do I need for a down payment?

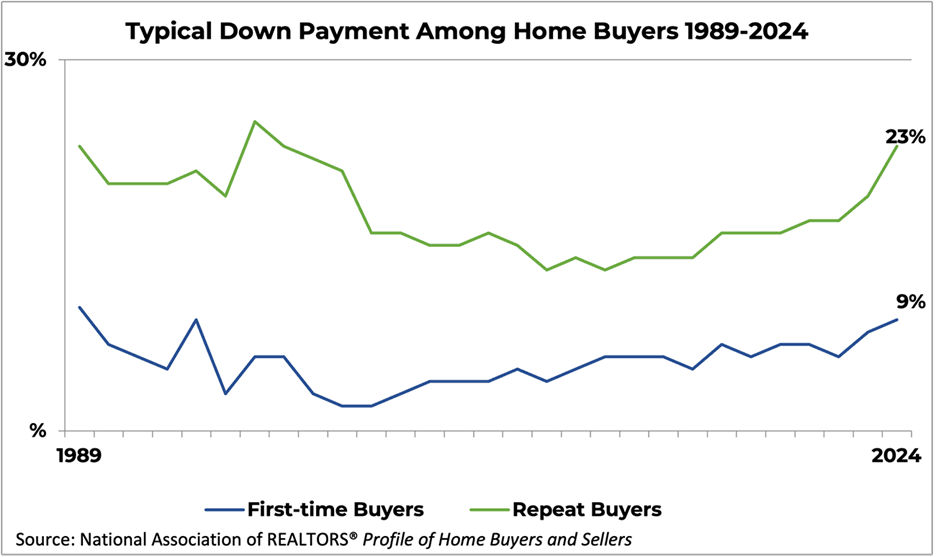

You’ve probably heard that you need to put 20% down to purchase a home. This is not true! 20% down is an option, not a requirement. The 20% rule is for buyers who want to avoid private mortgage insurance (PMI) but conventional mortgages can go as low as 3% for qualified buyers. FHA loans start at 3.5%. And VA and USDA loans can come with 0% down. And it is important to note that PMI isn’t forever. Once your loan-to-value reaches the 80% mark, you can remove it. It is basically a trade off: pay more up front in the down payment or have a slightly larger monthly payment by paying for PMI. So, how much do most homebuyers put down? Currently, first-time homebuyers are putting down an average of 9% while repeat buyers are putting down about 23%. [NAR]

Where does that money come from?

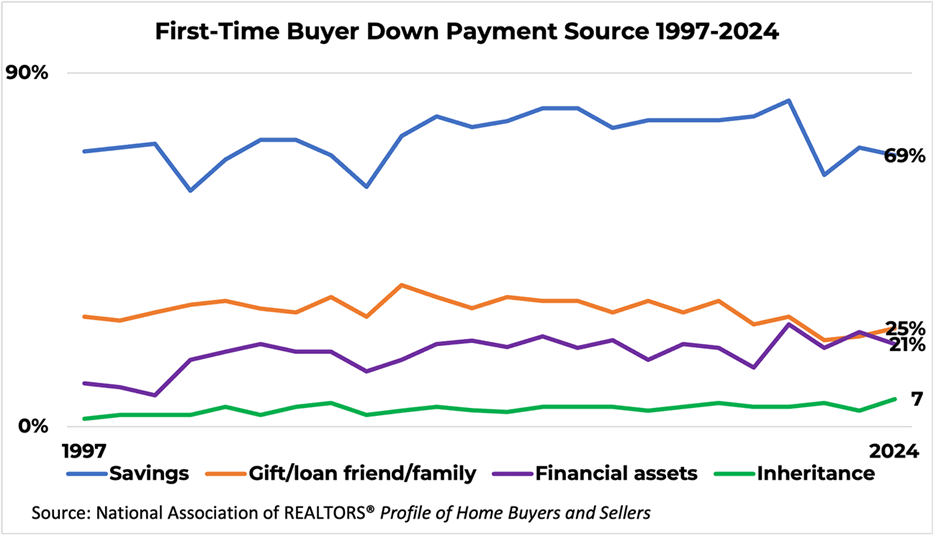

There is more than one way to fund a down payment. While nearly 70% of first-time homebuyers use savings for their down payment, 25% do so with gift funds from friends or family. A gift fund is money given to a borrower from someone close to them without any expectations for repayment. There are guidelines around who can provide gift funds and how the exchange is documented. But it is a great option for first-time homebuyers who have less saved up. Using financial assets like retirement funds and cryptocurrency for a down payment have become increasingly more popular ticking up from around 10% in 2000 to 21% in 2024. More Americans are using inheritance money to fund their down payments in recent years too. While the total percentage of people using this option remains low, it is growing. There are also some down payment assistance programs available to qualified first-time homebuyers. These programs, offered by local, state, and federal organizations, provide grants, loans, or other forms of aid to cover a portion or all of your down payment and closing costs. Researching and exploring these programs can open doors to affordable homeownership that you might not have considered before.

How much are closing costs?

In addition to the down payment, homebuyers will have closing costs due when they purchase a home. The costs vary but typically closing costs for conventional and FHA loans are 2-5% of purchase price, 1-3% for VA loans, and 2-4% for USDA loans. Be sure to investigate all of your options when it comes to funding closing costs. If you are able to negotiate a seller assist, they can help cover some of the expenses. You can also negotiate for lender credits by agreeing to a slightly higher mortgage rate in return for reduced closing costs.

You aren’t alone!

Nobody expects you to navigate the homebuying process on your own. Working with an experienced team including a mortgage broker and real estate agent can alleviate a lot of stress and streamline the process. Now that you’ve identified that you want to buy a home, it is a good time to connect with a local mortgage broker to review your options and any requirements you might need to prepare for (credit score, employment history, etc) before getting preapproved. If you have any questions about the homebuying process, our team at Philly Mortgage Brokers is here to help!