What is in a Credit Report?

A key item in any mortgage process is a credit report. It examines the financial health of a borrower. The components of a credit report combine to generate that all-powerful number, the credit score. Lenders use this information to measure potential risk. Generally, a stronger credit score has a lower risk of the borrower defaulting on a loan. A higher credit score is typically rewarded with lower interest rates.

Identifying Information

Very simply, this information is used to confirm who you are. This includes personal information such as name, social security number, address, and date of birth and has no affect on your credit score.

Payment History

A review of loan, credit card, and line of credit bills and payments is used to evaluate how capable you are at making timely payments. If you have missed a payment, be prepared to provide an explanation to the lender.

Credit Utilization

Credit utilization has one of the greatest impacts on your credit score coming in at up to 30% of your score.

Credit utilization has one of the greatest impacts on your credit score coming in at up to 30% of your score.

Credit utilization is viewed as a ratio of how much revolving credit is available to you vs. how much you use regularly. Revolving credit is credit that does not have an end date and primarily includes credit cards and lines of credit. Installment loans such as mortgages and car loans are not part of revolving credit because the loan amount remains the same and is paid down in even installments with an anticipated end date.

Lenders tend to prefer this ratio fall at or below 30%. For instance, if you have a credit card with a $10,000 limit and you tend to use $3,000 or less on average, you will fall within the ideal ratio.

Total and Per-Card Utilization

There are 2 types of credit utilization: total and per-card. Total utilization is an aggregate number of all your available credit rather than on an account-by-account basis. So, if you have 5 credit cards with a total of $50,000 and you only use $15,000 on average but you tend to use the max on one of the cards, you still have a total credit utilization of 30%. Per-card utilization is the percentage of available credit you use for each individual revolving credit account. In that same scenario, even though you only use 30% of your total available credit, you are nearing 100% for your per-card credit utilization on that one credit card. Both ratios impact your credit score making it important to keep them balanced.

Managing Credit Utilization

There are four main strategies for improving credit utilization. Be sure to examine how each affects you specifically before implementing one of these options.

There are four main strategies for improving credit utilization. Be sure to examine how each affects you specifically before implementing one of these options.

- Pay your credit balance in full (or as much as possible) monthly. This is very effective but only for those who have the funds to do so.

- Opening new credit accounts. This increases the total available credit. If you keep this new account at zero, you automatically improve your credit utilization ratio. This option could negatively impact your credit score in the short term.

- Requesting an increase in credit limit. This has the same result as opening a new credit account: it increases your available credit. Be sure you can keep yourself on a budget. If you might be tempted to take advantage of the higher limit and overspend, this option is not for you.

- Keep open current credit accounts with zero balances instead of closing them. This is a pretty safe option as long as you are able to avoid using the account. Much like number 3, if you might be tempted to spend more, this option could be risky.

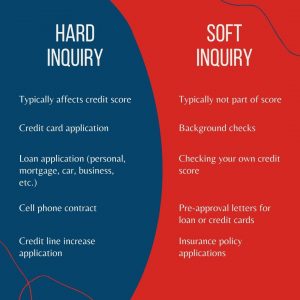

Recent Applications

Any application for credit or debt causes hard inquiries on your credit report. Examples include applications for a mortgage, auto loan, credit card, student loan, personal loan, and apartment rental.

Any application for credit or debt causes hard inquiries on your credit report. Examples include applications for a mortgage, auto loan, credit card, student loan, personal loan, and apartment rental.

One or two hard inquiries generally decrease your credit score mildly by a few points. Too many inquiries in a short time, however, can significantly decrease your credit score and raise a red flag to lenders by suggesting you might need the credit due to financial issues. Hard inquiries typically stay on your credit report for 2 years.

If you are looking to make a major purchase such as a home or car, it is best to avoid applying for other forms of credit around that timeframe. This includes the months leading up to the application all the way through closing the loan. Many mortgage lenders pull credit reports more than once during the span of time from applying to closing. The most common is once at the time of application and once just before closing to ensure there have not been any significant changes that would make the loan riskier to the lender.

Major Derogatories

Anything negative such as bankruptcy, judgement, delinquency, collections, account settlements for less than what was owed, and charge-offs all fall under the major derogatory category and negatively impact your credit score.

A Dispute Statement

A dispute on your credit report can slow down the underwriting process and generate more work for you and your lender. If you have a dispute on your credit report, it is best to wait for it to be resolved before applying for a mortgage.

Being An Authorized User

An authorized user is someone who can make charges to an account but is not able to alter credit limits and is not ultimately responsible for making payments. This is a common occurrence for people who have difficulty getting credit or are just starting to build credit. A prime example is a teenager on a parent’s account. While reliable credit history on an authorized user’s account can improve their credit score, the debt involved in the same account will increase their debt-to-income ratio (DTI), which plays a major factor in mortgage underwriting. Higher DTI translates to a lower approved loan amount. Removing yourself as an authorized user prior to applying for a mortgage can streamline the process and help you get approved for a higher amount.

Obtaining Your Personal Credit Report

Now that you know the pieces of the credit report puzzle, take some time to look at your information. Make sure the details are accurate and make a plan to resolve or improve any negative marks. There are 3 major credit reporting agencies in the U.S.: Equifax, Experian, and TransUnion.

Now that you know the pieces of the credit report puzzle, take some time to look at your information. Make sure the details are accurate and make a plan to resolve or improve any negative marks. There are 3 major credit reporting agencies in the U.S.: Equifax, Experian, and TransUnion.

You are entitled by law to one free credit report from all 3 agencies annually.

You can obtain your free report online at www.annualcreditreport.com, by phone at 1-877-8228, or by mail by filling out this form and mailing it to P.O. Box 105281, Atlanta, GA 30348-5281. Do not contact the 3 agencies directly as the only means of obtaining your free annual report is through the website, phone number, and address above. There are instances where you may be entitled to more than one free copy annually. The full list of circumstances can be found on the FTC’s Consumer Information website. The site also lists the contact information for the Equifax, Experian and TransUnion for buying additional credit reports when you have exhausted your free options.

Have questions? We’re here for you! From reviewing available options to referring to credit specialists to help you get on track, we will work to get you on the path to homeownership.