The 90 Day Rule for Cash Buyers

How to buy your house with cash and still get the mortgage interest tax deduction.

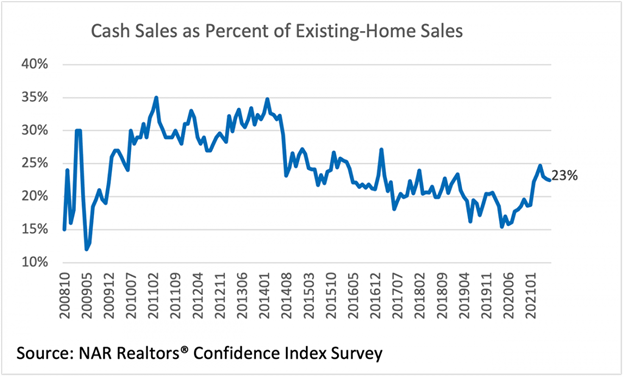

Buying homes with cash has increased drastically as buyers seek a competitive edge in the tight housing market. The percentage of cash buyers hit 23% in July 2021. If you have the means to purchase without taking out a mortgage loan, why wouldn’t you just pay cash? There are two factors to consider before going all in as a cash buyer.

- If you pay cash for your home, will you still have funds available for unforeseen maintenance and repairs or other life events?

This one is pretty simple. Having cash reserves for unexpected events is a key part of financial stability for any aspect of life. We’re not just talking about broken appliances or leaky roofs. It is important to be prepared for a health event or an employment change or any major financial event. If you put all you liquid assets into purchasing your home, you will not be properly prepared to weather a financial storm. If you cannot seal the deal on your dream home without a full cash offer, you might want to consider taking out a mortgage after closing on the sale to help you pull out some of the cash to refill your emergency fund.

2. You could miss out on a federal tax deduction.

If you itemize your tax deductions, you can deduct your primary or vacation home mortgage interest on up to $750,000 of acquisition indebtedness. For a $250,000 home with a $200,000 mortgage and an interest rate of 3%, your would have just under $6,000 in interest available to deduct in your first year (assuming you made timely payments and didn’t pay additional principal).

But the seller only wants a cash offer

There’s a solution. You have 90 days from closing on your home purchase to put a mortgage on your primary or vacation property and still be eligible for the tax deduction. We call this the 90-Day Rule. Note that this rule does not apply to investment properties.

Why would I want to place a mortgage on my property anyway?

With current rates at significant lows, you could use the funds to

- Invest in a safe option that yields more than your mortgage rate

- Set aside a college fund for children or grandchildren

- Build up your retirement portfolio. Many Americans aren’t saving enough for retirement. You could take this opportunity to infuse your retirement plan with a nice boost.

What’s the next step?

Connect with us. A short phone conversation will help you evaluate your options and whether a mortgage is the right choice for you. We suggest taking our recommendations to your CPA to get their opinion before finalizing a decision.