How Will Rising Interest Rates Impact Home Values?

WHY ARE INTEREST RATES GOING UP?

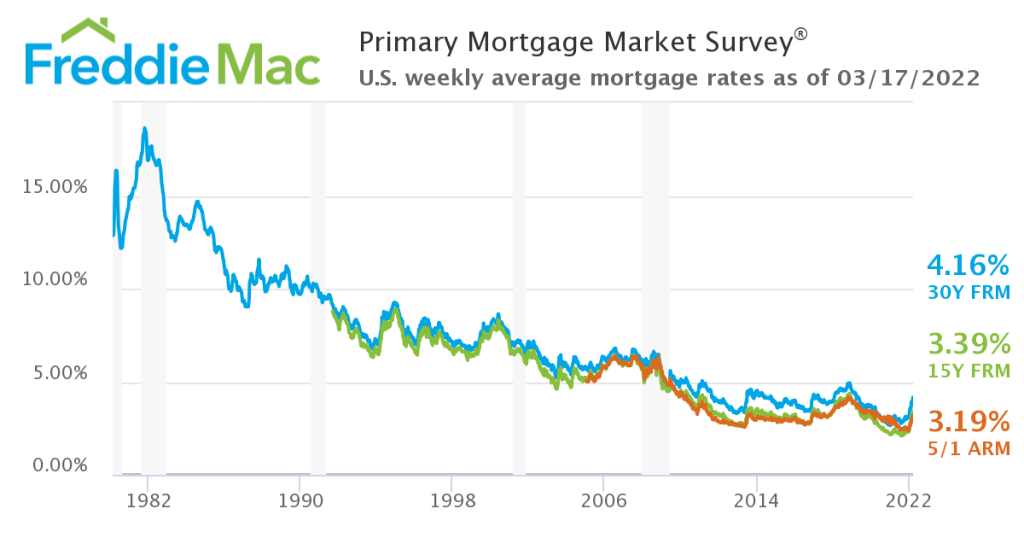

The Fed recently decided to reverse its pandemic-era stimulus programs, causing mortgage rates to jump by approx. 1% since the beginning of this year. Rates may continue to drift higher in the months ahead because inflation is at the highest level in decades. High inflation also leads to high interest rates.

HOW DO RISING INTEREST RATES IMPACT HOUSE PRICES?

Part of the reason for rising interest rates is that consumer inflation has been running around 7% per year recently, compared to less than 2% per year throughout much of the past 15 years. House prices tend to up along with all the other asset prices in the economy during periods of high inflation. During the last period of high interest rates and high inflation, from 1970 – 1989, the average increase in house prices was 7.64% per year. During the past 20 years of low interest rates and low inflation, from 2000 – 2019, the average increase in house prices was 3.70% per year. House prices tend to go up at a faster pace during periods of high inflation. That’s why real estate is often referred to as a “hedge against inflation.”

WHAT ABOUT HOUSING AFFORDABILITY?

The only way that rising interest rates will impact house prices is if monthly mortgage payments start becoming unaffordable for home buyers. This is a real risk in today’s market, especially given the 20%+ annual increase in house prices we’ve already seen during the past few years. Here are two things that may reduce this risk and keep monthly mortgage payments affordable:

- Rising Wages: average wages have increased by approx. 5% during the past year. The trend toward higher wages may continue because there are currently over 11 million job openings in the economy. In times like this, employers tend to increase wages to attract or keep the workers they need.

- Rising Rent Payments: average rents have increased by 11.5% during the past year, which was the biggest increase in 16 years. Mortgage payments may continue to be affordable relative to rent payments if rents keep going up.

WHAT SHOULD I DO ABOUT IT?

If you are in the process of purchasing or refinancing and have been offered a rate that works within your budget, lock it in. Locking your loan will guarantee you that rate as long as you close on the loan within the period of time you selected for your rate lock. For instance, if you plan to close on your home purchase in 20 days, you could choose a 30 day lock. Lock times vary. The longer the lock timeframe, the more expensive they are.

SHOULD I WAIT?

If you are waiting for rates to go down before taking the plunge into homeownership, you should think twice. Rate drops are never a guarantee. Home appreciation, however is fairly certain even if it doesn’t continue at the blazing hot levels of 2021. While 4% isn’t the near 2% rate offered in January of 2021, it is infinitely lower than the 10%+ rates from the 1980s or even the 8% rates we saw in 2000.

Rental increases are also a factor. With a fixed rate mortgage, your monthly mortgage expense is the same every month. Conversely, rental costs tend to increase annually. The current national average is 5.8% annual rental increase. For the Philadelphia region, it is currently 4.9%.

Not everyone is financially prepared to buy. If you are earlier in the mortgage process and just starting to consider whether this is the right time to purchase or refinance, reach out to a trusted mortgage professional to talk through your specific scenario. They will review your goals and your needs and help provide you with options. If you are looking for mortgage advise, please give us a call.