How to Get the Primary Residence Capital Gains Tax Exclusion

In order to understand capital gain, we first need to understand tax basis. Your tax basis is the cost of buying, building or improving a property. Assume you pay $200,000 for a property. You incur $5,000 in closing costs. Then you spend $45,000 on home improvements. In that case, your tax basis would be $250,000. That’s what it cost you to buy and improve the property.

Assume you later sell the property for $500,000. You incur $50,000 in sales commissions, transfer taxes, and other sales expenses. You then subtract your $250,000 basis. Your capital gain would be $200,000.

Once you figure out your capital gain on a property, the next step is to calculate your taxes. In our example, if you earn a $200,000 profit, you would likely owe $30,000 in capital gains taxes because the capital gains tax rate is currently 15% for most taxpayers.

In 2013, there was an additional 3.8% net investment income tax that was added by the federal government to help pay for changes to Medicare. This new tax applies to single taxpayers who earn more than $200,000, or married taxpayers who earn more than $250,000. You may need to pay an additional $7,600 investment income tax in this scenario.

THE PRIMARY RESIDENCE EXCLUSION

If the property is your primary residence, you have what’s called a principal residence exclusion. This means that a certain portion of the capital gain is excluded from tax. Married couples can exclude $500,000 of capital gain from tax. Individuals or married couples filing a separate tax return can exclude $250,000 of gain from tax. In the example above, the entire $200,000 would be excluded from tax if this was your primary home. This means that you’d save at least $30,000 by using this exclusion (no capital gains tax and no 3.8% investment income tax)!

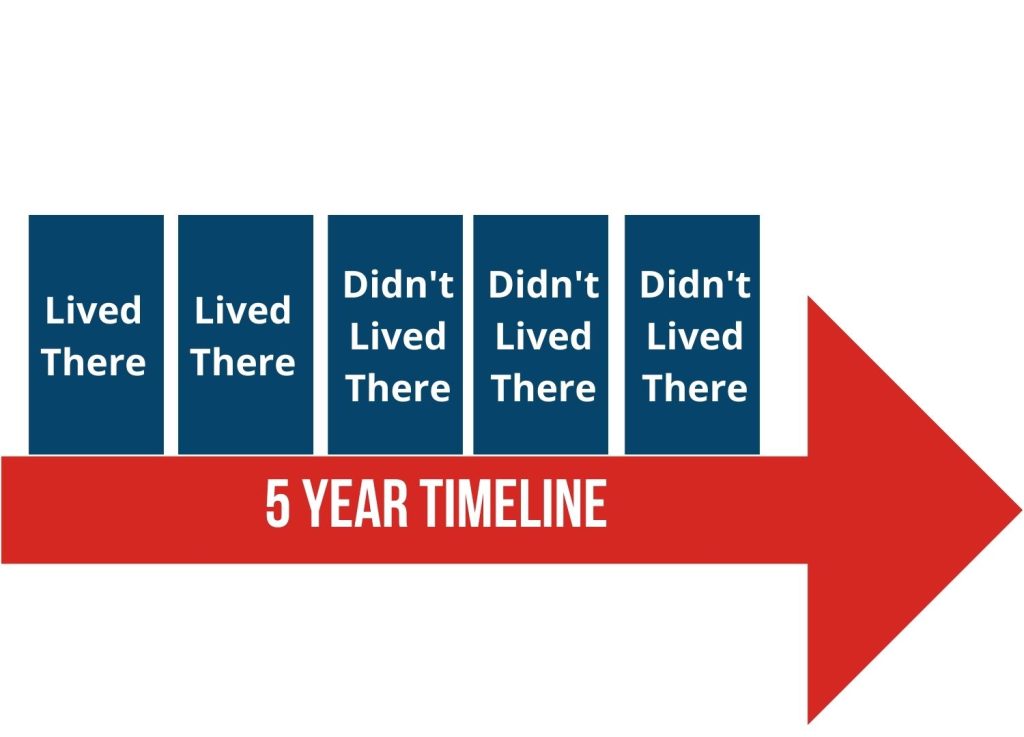

TO QUALIFY FOR THIS EXCLUSION, YOU MUST LIVE IN THE HOME AS YOUR PRIMARY RESIDENCE FOR TWO OUT OF THE LAST FIVE YEARS.

YOU DON’T HAVE TO USE THE PROCEEDS TO BUY ANOTHER HOME.

YOU CAN USE THE EXCLUSION ONCE EVERY TWO YEARS.

If you have a large capital gain on your property, why don’t you consider selling it now, and pocketing the proceeds tax-free? Then, you can purchase another home and do it all over again because there’s no limit on how many times you can get this exclusion! You just have to wait 2 years in between each sale and make sure that you live in the property as your primary residence.

THE EXCLUSION ONLY APPLIES TO PRIMARY HOMES.

This exclusion doesn’t apply to vacation homes or investment properties. It only works if you live in a property for two full years out of the last five full years. Also, there are some limitations on the exclusion if you turn a rental property into a primary home.

EXTRA CALCULATION APPLIES IF YOU CONVERT A RENTAL PROPERTY INTO A PRIMARY HOME.

If you rent out the house BEFORE you live there as your primary residence, the calculation of how much gain you can exclude is based on the percentage of time that you’ve lived in the home as your primary residence. For example, if you rent out the house for three years, and then you move in and live in the house for the next three years, you can only exclude 50% of the gain. This is because you only lived in the house for 50% of the time you owned it. This calculation must be performed even if you originally bought the house as a primary home, but didn’t live there until after you rented it out. However, if you rent out the house AFTER you’ve lived in it as your primary home, you do not need to perform this extra calculation.

PLEASE NOTE: THIS LETTER AND OVERVIEW IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE LEGAL, TAX, OR FINANCIAL ADVICE. PLEASE CONSULT WITH A QUALIFIED TAX ADVISOR FOR SPECIFIC ADVICE PERTAINING TO YOUR SITUATION. FOR MORE INFORMATION ON ANY OF THESE ITEMS, PLEASE REFERENCE IRS PUBLICATION 523.