How Has Homebuying Changed in the Past 20 Years?

It’s been a while since you bought your last house. Maybe it was the home you raised your children in, they are all now grown and you’re ready to downsize. Perhaps your parents are getting older and need a little help and you are looking for a multigenerational home. Or maybe you have been dreaming and saving for that special vacation home, and you are finally ready to buy a second house. For whatever reason, you are looking to purchase a home. You’re not new to homebuying, but it has been a while, decades even, since you purchased your last home. How has homebuying changed in the past twenty years? Well, more than you’d expect. The most obvious answer here is the one you see all over the headlines: affordability.

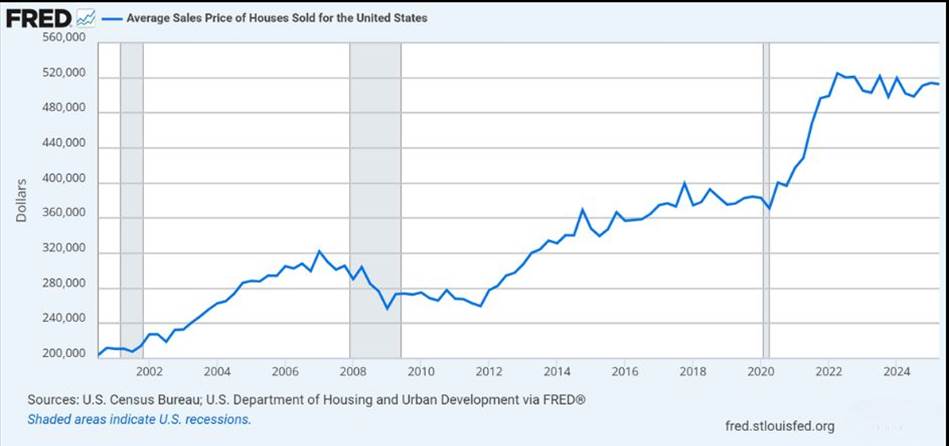

Home Prices

Home prices are up, way up. The national median home price in the early 2000s was under $200,000. Today, it is more than double that and, in some areas, triple. The good news is that your current home has likely risen in value during that time as well leaving you well positioned to buy a new or second home with the equity in your current one.

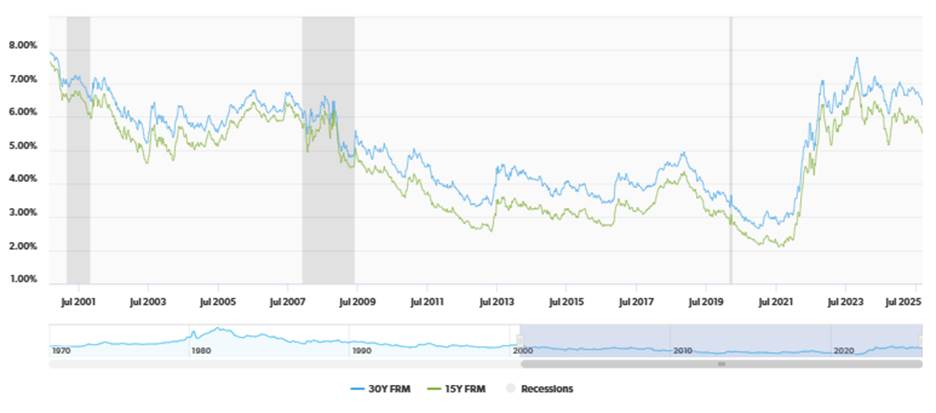

Interest Rates

Typical conventional interest rates in the early 2000s were fairly similar to what we’re seeing today (September 2025). We are currently hovering around 6.35% for a typical 30-year conventional loan. [Fredie Mac] But if you took advantage of the historically low rates we saw in 2020-2021 and refinanced, you might have a mortgage closer to 2-3% right now. And that is a significant difference from today’s available rates.

Source: Freddie Mac

Beyond affordability, the process of getting a mortgage has transformed in the past twenty years thanks to stricter guidelines and new technology.

Mortgage Guidelines

Due largely to the housing market crash of 2008, mortgage lending guidelines have seriously tightened. If you haven’t applied for a mortgage in the last 20 years, prepare for more questions and documentation than the last time. Common requirements include:

- Paystubs from at least the past 30 days

- W-2 Forms for the past 2 years

- Other income verification: child support, alimony, social security, etc.

- Bank statement for the last 2 to 3 months

- Investment and retirement account statements

- Gift letter (if receiving down payment help from a friend or family member)

- Personal identification: Government issued ID, social security card

- Rental history (typically proof of timely rental payments for the past 12 months)

- Residency status documentation (green card, visa, etc)

- Current mortgage statement (if you already own a home)

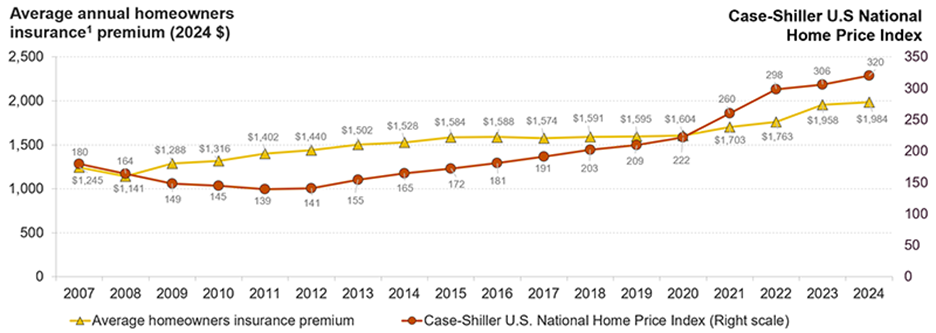

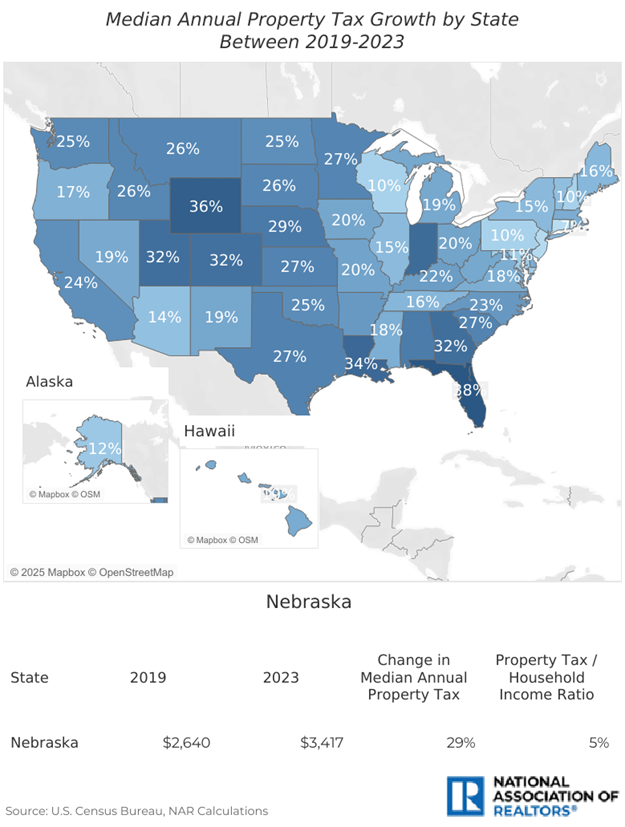

The Cost of Homeownership

In addition to your monthly mortgage payment, you also have homeowner’s insurance, property taxes to consider. “From the Great Recession to the present, homeowners insurance prices have increased 74 percent while home prices have increased more than 40 percent, even after adjusting for inflation.” [Joint Center for Housing Studies of Harvard University] Rising in tandem with home prices is property taxes. In just the 4 years from 2019 to 2023, the national median annual real estate tax surged by 23%. [NAR]

Source: Joint Center for Housing Studies of Harvard University

Technology and Homebuying

One exciting change in the homebuying process is the technology! Gone are the days of sifting through mountains of paperwork, scheduling in-person meetings, and hand cramps from signing a million documents. With secure digital file uploads, e-signatures, mortgage application software, and video conference tools, you can typically apply and sometimes even close your new home mortgage from the comfort of your home. New mortgage loan technology can automatically update you as your loan application progresses along, send you task reminders, and help shorten the time it takes to gather and review your information.

What Hasn’t Changed in 20 Years?

Owning a home is still one of the best long-term ways to build wealth. Relationships still matter, too! Working with an experienced and reliable mortgage broker can help streamline the process, avoid surprises, and alleviate stress. Getting pre-approved is still the number one step in the homebuying process. It helps you know how much a lender is willing to let you borrow and it shows sellers that you are serious when making an offer. If you are considering purchasing a home, we’re here to help you get started.