How Does An Economic Recession Affect the Housing Market?

RECSSION. The word has been tossed about quite a lot over the past year. It can be a scary word but it can also be a secret weapon for homebuyers. Let’s break down the basics: what is an economic recession, how does it impact the housing industry, and what should you do about it?

What is an economic recession?

An economic recession is a natural part of the economic cycle which has regular peaks and valleys. Per Merriam Webster, the simplest answer is “a period of reduced economic activity.” The National Bureau of Economic Research (NBER) defines a recession as “a significant decline in economic activity that is spread across the economy and that lasts more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales”

Essentially, during a recession, the cost of goods tends to increase which negatively impacts purchasing power causing consumers to scale back their spending. When consumers spend less, manufacturers tend to decrease production and minimize their workforce.

What causes a recession?

There are a variety of potential reasons for a recession ranging from a sudden economic shock to inflation that goes unchecked for too long. The most recent recession in the U.S. was seen in 2020 due to the Covid-19 pandemic (economic shock). It was the shortest recession in U.S. history only lasting 2 months.

Are we headed toward a recession?

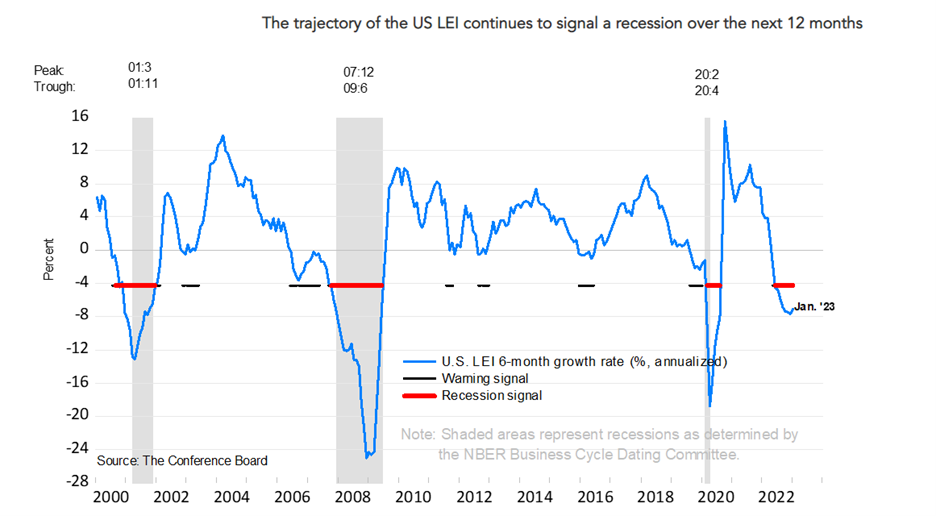

As of February 21, 2023, it seems very likely. The Conference Board’s index of leading economic indicators (LEI) fell 0.3% in January 2023 marking the 10th straight month of decline. The six-month grow rate is currently at -7.4%. When this number falls below -4.2%, it is considered a recessional signal.

Note: The chart illustrates the so-called 3D’s rule which is a reliable rule of thumb to interpret the duration, depth, and diffusion – the 3D’s – of a downward movement in the LEI. Duration refers to how long-lasting a decline in the index is, and depth denotes how large the decline is. Duration and depth are measured by the rate of change of the index over the last six months. Diffusion is a measure of how widespread the decline is (i.e., the diffusion index of the LEI ranges from 0 to 100 and numbers below 50 indicate most of the components are weakening). The 3D’s rule provides signals of impending recessions 1) when the diffusion index falls below the threshold of 50 (denoted by the black dotted line in the chart), and simultaneously 2) when the decline in the index over the most recent six months falls below the threshold of -4.2 percent. The red dotted line is drawn at the threshold value (measured by the median, -4.2 percent) on the months when both criteria are met simultaneously. Thus, the red dots signal a recession.

How does a recession impact housing?

There are two major ways an economic recession can impact the housing market.

- Typically, during a period of inflation, consumers decrease spending. This can translate into fewer homebuyers. For those interested in buying, this can equate to less competition and more favorable negotiations with sellers.

- The Federal Reserve has a history of lowering interest rates in the face of a recession to help make products more affordable and encourage spending. When the Fed reduces interest rates, mortgage interest rates typically also decrease.

Is it a good idea to buy a home during an economic recession?

While everyone’s individual circumstances vary, a recession can be a great opportunity to purchase a home if you are fortunate enough to have the economic stability to do so. If your employment and savings are in shape, you could take advantage of the lower interest rates and decreased competition to purchase a home at a lower monthly cost.

Bear in mind that during a recession, more stringent parameters for qualifying for a mortgage can be implemented by lenders to limit their risk. These could include higher credit score minimums and larger down payment requirements. This was particularly true during the Great Recession of 2008. Be prepared by keeping your debt low, paying your bills on time, and setting aside a reasonable down payment.

Another great opportunity during an economic recession is refinancing. If you purchased your home during an inflationary period when interest rates were higher, you could potentially refinance to a lower rate and see significant monthly savings. You could also utilize this period of lower rates to put your home’s equity to work with a cash-out refinance to pay down debt, remodel your home, invest, or splurge on a dream vacation.

Keep in mind that recessions don’t last forever. If what goes up must come down, then the reverse is also true and interest rates will eventually increase. If you’re considering buying or refinancing, reach out to us today to set a plan in place so you are ready should a recession occur.