How Can FHA Help Me Buy A Home?

What is a FHA Loan?

Federal Housing Administration (FHA) loans are designed for people who don’t qualify for a conventional loan, generally due to lower credit scores or limited funds for a down payment. These loans are federally backed mortgages that are issued by FHA-approved lenders. The FHA does not lend the money. They do guarantee the loan to the lender. If a borrower defaults (fails to pay their mortgage), the FHA’s insurance will pay a claim to the lender. This provides less risk for the lender and allows them to have more achievable standards. It is a great way to get started as a homeowner when your finances and credit aren’t ideal.

FHA loans are not just for first-time buyers.

Basic requirements

- Lower credit score limits. FHA loans have a minimum credit score of 500. *Individual lenders have higher requirements called overlays.

- Low down payment requirements. Your specific minimum down payment on a FHA loan is determined by credit score.

- 500-579: 10% Down

- 580+: 3.5% Down

- FHA loans are generally best for credit score under 680 in terms of affordability in rate vs. mortgage insurance premiums.

- 2-year history of stable employment.

- This does not have to be at the same job, but it is best to be in a similar field if there is a job change in the 2-year history.

- Debt-To-Income Ratio (DTI)

- Front end (future housing payment/income): 36.99%

- Back end (monthly debt payments such as car payments, student loans, and credit cards): 56.99%

- Income Based Repayment (IBR) for student loans is not considered with a FHA loan. If you are on IBR and have a tight DTI ration, a conventional loan might be a better option for you.

- Must be the primary residence for at least 1 year prior to renting it out.

- 2-4 units are allowed. This means you live in1 unit and are allowed to rent the other units.

- Condos must be on the FHA-approved list.

- Property flip rule. Must wait 90 days from purchase to selling the property.

Overlays

While FHA lays out the basic requirements for eligibility, individual lenders can add additional or stricter requirements to limit their risk. For example, while the credit score minimum for FHA is 500, many lenders require a score higher than 500.

Special Circumstances

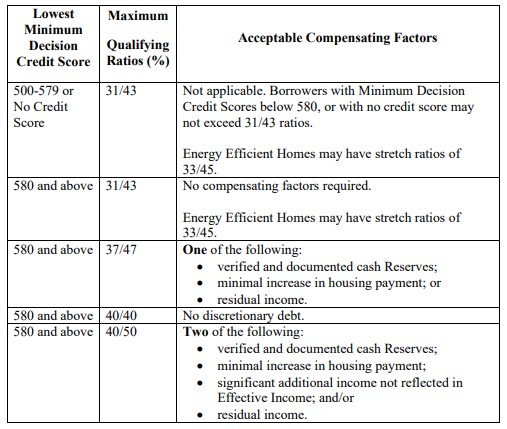

The basic requirements listed above are generally evaluated by Desktop Underwriting (DU) which is completed by a computer. If a loan isn’t eligible via DU, FHA does allow manual underwriting. In this process, special circumstances are explained, and a lot of additional supporting information is required. When an FHA loan goes into manual underwriting, the maximum DTI ratios decrease, and additional requirements called Acceptable Compensating Factors are added. The current ratios for manual underwriting as of November 2021 are:

Loan Limits

Loan limits update annually and are based on the county in which the home is located. Here is a link to look up specific FHA loan limits by county. The base loan limit for 2021 is $356,362. Keep in mind that your loan amount is not the same as the purchase price of the property. You must put at least 3.5% down and you will have up-front mortgage insurance wrapped into your loan amount. To calculate your maximum purchase price (assuming 3.5% down) you take the loan limit for that county and divide by .965. For example, the loan limit for a Fannie Mae or Freddie Mac FHA loan for single family home in Philadelphia County for 2022 is currently $477,250. That means the maximum purchase price you could have for this loan when putting down 3.5% would be $477,250/.965 which is $494,590.

Appraisals

This is one of the toughest parts of a FHA loan. There are significantly stricter appraisal guidelines for an FHA loan compared to a conventional loan. In general, they are looking for the following standards:

- Health and safety

- Structural soundness

- Move-in ready

If a standard is not met, the issue must be resolved and a 2nd appraisal confirming the adjustments must be performed. That slows down the purchase process and comes with a 2nd appraisal fee. It is best to be on the lookout for these potential issues prior to scheduling an appraisal so that the issues can be resolved before the 1st appraisal. A good realtor should be able to help you spot any potential concerns and. Some common issues we encounter in the FHA appraisal process are:

- Chipping paint

- Exposed wiring

- Broken glass

- Wet basement/crawlspace

- Plumbing issues

- Rotting wood

- Broken HVAC

Down Payment Sources

- Collateralized loans like 401k or a home equity loan can be used to cover your down payment.

- You cannot use unsecure loans such as credit cards or personal loans.

- A family member loan is allowed to be used.

- This can be secured where the family member has a claim to the property or unsecured where they have no claim.

- Gift money is another great option.

- They must be from close personal friends with a documented relationship. It can even be from an employer.

Credit Events

FHA is more lenient with credit events.

- Generally, they will allow 2 late payments within past 12 months for revolving credit and 1 late payment for installment credit.

- If you have more than $2,000 in non-medical collections, you have 3 options: payment plan, pay it off, or 5% of the balance will be included in your debt-to-income ratio (DTI).

Waiting Periods for Major Credit Events

| Deed in lieu, Foreclosure, Short Sale | 3 years from deed transfer |

| Chapter 7 Bankruptcy | 2 years from discharge |

| Chapter 13 Bankruptcy | 12 months of on-time payments and court approval |

Mortgage Insurance

There are two types of mortgage insurance associated with a FHA loan and they are both required. Unlike a PMI with a conventional loan, these percentages remain the same for all credit scores. Also unlike conventional PMI, this insurance requirement does not end when you reach 20% equity. If you put at least 10% down, it will end in 11 years. If you pay less than 10% down, it will remain for the entire life of your loan. This is a huge incentive to refinance if your financial situation improves and you can qualify for a conventional loan.

- Up-front Mortgage Insurance: 1.75%

- Wrapped into the loan. For example, if you are looking for a $300,000 FHA loan, an additional 1.75% ($5,250) will be added to the amount you are borrowing for a total loan amount of $305,250.

- Mortgage Insurance Premium: .85%

- This is very similar to PMI (Private Mortgage Insurance) for a conventional loan.

Keeping an FHA Loan

This loan type was designed to help people with lower credit scores and limited down payment funds to have the ability to buy a home. While FHA loans are a great way to get a home, it is not ideal to keep for too long because of the expensive mortgage insurance it requires. If your situation improves and you become eligible for a conventional loan, you will likely save money by refinancing into a conventional loan.

Refinancing an FHA Loan

There are two great options for refinancing an FHA loan. If rates have dropped but your situation has remained relatively the same in regard to credit score, FHA Streamline is a good option. If you have improved your credit score and are eligible for a conventional loan, you could potentially save a good deal with a lower rate and the removal of mortgage insurance. There are circumstances where your credit may have improved enough to be eligible but it isn’t high enough to reap the benefits of a lower interest rate simply by going conventional. Be sure to consult with your mortgage broker to know what the guidelines are and what benefits you the most.

- FHA Streamline

- Only available for homes already FHA insured.

- Credit, income, and appraisal aren’t required. This process is quick and carries fewer fees.

- Must result in a net tangible benefit to the borrower. This definition varies but generally involves a lower interest rate or more favorable terms for the borrower.

- No cash-out option. Maximum of $500 cash in excess.

- FHA to Conventional

- Income, credit, and appraisal are required.

- If your credit score has improved, you are likely able to get a better rate

- By removing MIP, you generally save money.

If you have questions about FHA loans and your options, please contact us. We’re here to help you examine all of your options.