Debt-to-Income Ratio (DTI)

We all know that our credit history plays a major role in determining eligibility for a loan but there is another factor that can have as great and often greater influence on your mortgage application’s approval: debt-to-income ratio (DTI). In fact, 35% of mortgage applications that were denied in 2021 were due to high DTI according to the NAR Home Buyer and Seller Generational Trends report. Compare that to the 24% that were denied due to credit score, and you can quickly see how important DTI is. So, let’s dive in and explore what DTI is, how it is calculated, what scores lenders look for, and what you can do to improve your DTI.

What is DTI?

Debt-to-Income Ratio is all your monthly debt payments divided by your gross monthly income. Lenders use this number to estimate your ability to repay the amount you plan to borrow for your mortgage.

Front-End vs. Back-End DTI

There are two types of DTI calculations: front-end and back-end. Front-end DTI looks exclusively at your housing expenses while back-end DTI is more comprehensive and includes other financial obligations such as student loans, alimony, child support, installment debts, revolving debts (credit cards, lines of credit), and monthly lease payments.

How is DTI calculated?

To calculate your DTI, add up all your monthly debt payments and divide them by your gross monthly income. Debts generally include these monthly expenses:

- Mortgage or rent

- Real estate taxes

- Home owner’s insurance

- Car payments

- Student loan payments

- Credit card payments

- Personal loan payments

- Child support payments

- Alimony payments

- Any co-signed loan payment

Examples of common monthly expenses not included in the debt calculation are utilities, car insurance, health insurance, and grocery costs.

Typically gross income is the amount of money you earned before taxes and other deductions are taken out. Income generally includes:

- Wages

- Salaries

- Tips and bonuses

- Pension

- Social Security

- Child support and alimony received

Let’s look a DTI calculation example.

Monthly Mortgage Amount Sought: $1,500. Monthly salary: $5,000

| Debts | Amount |

| Car Payment | $300 |

| Student Loan Payment | $200 |

| Real Estate Taxes | $400 |

| Homeowner’s Insurance | $150 |

| Credit Card Payment | $300 |

| TOTAL with $1,500 mortgage | $2,850 |

So, the total monthly debt is $2,850 and the monthly salary is $5,000. That means the debt-to-income ratio is 2,850/5,000 which equals 57%.

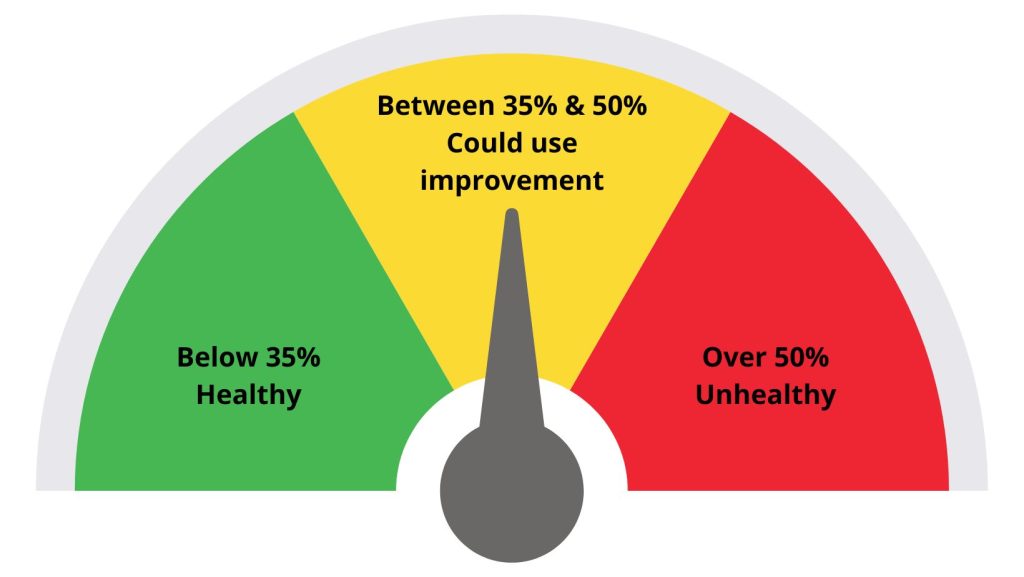

What is a good debt-to-income ratio?

While most lenders will accept a DTI as high as 43%, it is recommended that your DTI including your mortgage be no greater than 36%. There are also perks to having low DIT. Generally, the lower your DTI, the more favorable the terms (such as interest rates) available from the lender. DTI criteria vary depending on the loan type and the lender, so be sure to ask your broker about all of your available options.

How can I improve my DTI ratio?

Improving DTI boils down to decreasing monthly recurring debt, increasing gross monthly income, or a combination of the two. To increase income, you could take on extra work hours, request a pay increase, or pick up an additional job. Paying off debt requires cash on hand which isn’t always feasible, especially if you are working to save for a down payment. If you are confident you can make the monthly mortgage payments but your DTI is too high, you could consider a cosigner.

Questions?

We’re here to help you review your scenario. We can also review options to reduce your DTI to help you secure the loan that works best for you. If you do need to reduce your DTI, that process can take a little time. If you’re thinking about buying a home within the next year, don’t wait until the application process to reach out.